With cryptocurrency and NFTs becoming a more regular investment, what are holders to do when it comes to protecting their investments? Thirty years later and five years into private legal practice, I still find myself referencing the “6 P’s of Success,” which my father drilled into my head during my collegiate career.

“Prior planning prevents piss poor performance.”

And for practicing attorneys, this is a simple methodology of approaching any client representation to mitigate the potential for malpractice. Indeed, our legal landscape is predicated upon attorneys implementing the “6 P’s” in hopes of preventing any mishaps, which could be grounds for an undesired verdict/judgment, malpractice/disbarment, and/or a “shit-out-of-luck” scenario.

And for new technologies such as digital currency and other forms of digital assets, such as NFTs, everyone from Gen-X’ers, Millennials, and now Gen-Z needs to think ahead in ensuring their newly acquired assets are protected and transferable, in the event something happens to them.

Transferring My Digital Assets to a Loved One

For cryptocurrency enthusiasts (and holders), it is commonly known that crypto is held within a “wallet” (hot or cold), and in the event, the crypto holder loses their private key and seed phrase, there is no “support” you can call to reclaim your funds. Your money is forever out there, in limbo.

All of this leads to the reason why investors and holders should properly account for how those assets are to be documented, stored, protected, and transferred to loved ones in the event of the asset holder’s passing.

For the uninitiated, in order for cryptocurrencies to be transferred to someone else, they must be both (1) legally transferred and (2) technologically accessible so that the executor of the estate can either transfer those assets or sell them, to comply with the terms of the last will and testament.

In a 2018 article I wrote during my time with Forbes, I addressed a number of concerns surrounding digital inheritance as it pertains to the then-newly surfaced phenomenon of digital currency.

What I have learned in the past three years, is that as Bitcoin (CRYPTO:BTC) and other forms of digital currency become more prevalent in our everyday lives, the need to protect and account for those assets long-term becomes even more essential, now that NFTs or non-fungible tokens have experienced explosive growth in recent months.

Quick Recap on NFTs

NFTs work as a type of digital certificate of authenticity, stored in code on the Blockchain. Rather than the NFT owner holding a physical sheet of paper proving the authenticity and ownership of that particular item, the NFT is a string of unique characters, or code, that represents anything from music, videos, lyrics, artwork, and the list goes on.

“The reason that we’re talking about NFTs in this way is because you have people who spent millions of dollars on these works, and therefore because there’s a lot of money involved, the spotlight comes on them,” said Shane Tilton, associate professor of multimedia journalism at Ohio Northern University and the author of the upcoming book “Meme Life.” “It basically gave meme creators a chance to re-promote their work because now there’s a spotlight and stage to show their work to either a new audience or an audience that has forgotten.”

You may have recently come across a slew of memes that have since been converted into NFTs, including Laina Morris’ “Overly Attached Girlfriend,” Tabatha Bundesen’s “Grumpy Cat,” Kyle Craven’s “Bad Luck Brian,” and Zoe Roth’s “Disaster Girl.”

The original image of Roth was taken back in 2005 near a planned and controlled burn, which became an iconic meme known as “Disaster Girl.” The image of Roth, depicts her small face grinning somewhat ominously at the camera, while firefighters work to save a burning home behind her, as NBC News described it.

Sixteen years after the original photo was taken, Roth, 21, just sold that photo as an NFT for nearly $500,000, paying off her student loans; Morris sold her “Overly Attached Girlfriend” meme for approximately 200 Ether ($411,000 USD), and Craven sold “Bad Luck Brian” back on March 21 for approximately $36,000.

The point here is that the new holders of these respective NFTs now have legal possession of them in their own crypto wallets, which have (not insignificant) actual monetary values associated with them.

But what are individuals like Roth, Morris, and Craven doing to protect their assets? What are individuals who have purchased the NFTs from these creators doing with their newly acquired assets?

If I were to guess, it would be safe to assume that “nothing” or “not enough” are the answers to those two questions. So, for NFT holders and crypto-enthusiasts holding onto assets, perhaps it’s time to start looking for legal counsel well-versed and equipped in cryptocurrency, digital inheritance, and estate planning to assist you for long-term planning.

How Can Attorneys Properly Guard Client Crypto Assets?

Once a client walks through your doors and informs you that they are a holder of Bitcoin, an altcoin, or something called an NFT, the traditional estate planning process changes a bit in terms of the steps needed to properly account for these new types of assets.

Pursuant to the Model Rules of Professional Conduct, attorneys are required to provide competent, diligent, and zealous representation to their clients. This also infers that an attorney may also need to seek out the knowledge necessary to adequately and accurately represent their client, otherwise, outsource it to another counsel who is well-versed. Either way, you need to be able to have a conversation about digital currency, the Blockchain, and NFTs. Sorry.

Despite what you may think, just because NFTs are today’s newest type of digital asset, doesn’t mean our traditional legal landscape changes. It doesn’t. It just means that you as an attorney, need to be ready, willing, and able to consult with a potential (or existing) client on how to go about accounting for their digital assets.

It is my opinion that attorneys such as myself, now more than ever, need to understand how to address prospective and current clients invested into these types of assets.

As a client, I had two questions:

One, what happens if I didn’t include my crypto or digital assets in my will?

Second, what happens if my attorney doesn’t ask me about my crypto holdings?

And as a legal practitioner, I had three more:

First, what happens when a failure to ask, log or maintain a private key/passphrase results in the permanent loss of a client’s digital assets?

Second, what happens when an attorney managing their client’s estate doesn’t know to ask about digital assets?

Lastly, what happens if the attorney knows their client has crypto investments but is unable to access them (via a gap in technical knowledge or never having access to it)?

My questions, of course, beg the question of how to maintain the balance of protecting the purchased digital assets with ensuring that in the event of the owner’s passing, they are safely, securely, and efficiently transferred to the owner’s heirs, so as to avoid the assets being labeled “uninheritable” following the owner’s death.

Safe Haven Offers a Solution to Help Aid Attorneys Mitigate Malpractice

Gone are the days of just using a single case management system (CRM/CRS) such as Abacus, Cleo, PracticePanther, or MyCase.

Now, you may want to use a combination of systems or one that incorporates digital assets into a legal client database, as attorneys need to ensure they are compliant with their professional duty to safeguard the security of client information, which includes the security of private key data. This means not entering this information into any of these systems, to avoid the risk of data being hijacked or stolen from these traditional legal CRM databases.

In hopes of having some of my questions answered as a client and a practicing attorney, I reached out to a company I had heard whispers about through my own legal community that specializes in digital inheritance: Safe Haven, a digital inheritance provider, which (quite successfully) launched its decentralized data inheritance platform known as Inheriti, on the VeChain mainnet in 2020. For attorneys such as myself who have dipped their toes into the world digital assets and estate planning, this seems to be a practical solution for licensed attorneys to “stay in the know,” and not inadvertently violate our ethical responsibilities to our clients.

Safe Haven’s technology, in my opinion, serves as one of the most important releases in the crypto space today, presenting to be one of the truest forms of decentralized data inheritance.

Short for “inheritance,” Safe Haven’s Inheriti is a web3 platform and application, which promises to act as a bridge between the traditional and digital inheritance markets, The company utilizes a combination of blockchain and Hardware Security Module (HSM) device technology (utilizing Safe Haven’s own ‘SafeKeys’) to safely distribute heavily encrypted pieces (literally separate ‘key shards’) of inheritance information to separate cold-storage devices.

How It Works

Remember, in order for an individual to access or transfer his/her/their own cryptocurrency, they must use their private key, which is essentially equivalent to a password. This key takes the form of a seed phrase, or a randomly generated list of 12 words that are statistically impossible to guess or force. Meaning, if you lose any single part of that 12 word list, you’re screwed and that crypto sits in limbo…forever.

Setting Up Your Plan

The Owner of the Estate (OE) and user will first create a single sign-on (SSO) account with SafeID, to access the Inheriti platform, which are login credentials that also provides access to other Safe Haven’s product platforms. Once an OE/user logs into the Inheriti platform, the UI/UX will display available plan options – with only the Family Circle of the Community Edition available to the public as of the date of this article.

The Family Circle enables an OE/user to either set up a decentralized inheritance plan for a group of members, such as family and friends, or establish a personal backup of their private key seed phrases as a precaution against unpredictable and unforeseen catastrophes. Only the information regarding the plan itself (e.g. plan name, plan description, beneficiaries, interested parties, and of course, legal counsel) is stored securely on Safe Haven systems.

Through the extremely clever use of Safe Haven’s own (patents pending) Secret Sharing Distribution Protocol (SSDP) that splits the private key seed phrases into separately stored “shares” – none of the secret data itself is actually stored in Safe Haven’s back-end repositories.

Beneficiaries and the Role of ‘Merge Authorities’

During plan creation, the OE/user is able to enter information (including name and contact details) for each of the beneficiaries along with the minimum number of beneficiaries needed to unlock the inheritable data.

One of the most important aspects of creating an Inheriti plan, is that OE/users are able to specify the role of a “Merge Authority” – this is the person who will be nominated to initiate the ‘Merging-of-Shares’ process that will result in the unlocking of the secret data.

The Merge Authority can be one of the Beneficiaries themselves or, importantly, can be a trusted third-party individual that can be tasked with initiating the process following the untimely death of the Owner of the Estate.

And, in the event that a separate Merge Authority is chosen (i.e. that is not also a beneficiary), the Inheriti platform separates the requirement of the Merge Authority to initiate the formal recovery process from the ownership of the inheritable data itself.

The platform also includes a number of failsafe mechanisms (i.e. various ‘Dead Man Switch’ protections) that ensure the recovery process cannot be completed when the OE is still alive.

For the OE, this important distinction represents significant peace of mind, where an OE can nominate an individual (or organization) in a formal Merge Authority role without worrying about bad actors that can unlawfully initiate the process and unlock the inheritable data without the full cooperation of the required number of beneficiaries too.

For attorneys, Safe Haven’s Inheriti presents the perfect opportunity … not only does it allow us to extend our Estate Planning services to this most niche (and attractive) of sectors in a safe and secure manner, it allows us to do so in a manner that safeguards the ultimate safety of our clients’ secret / private key data whilst ensuring that the financial value attributable to an Estate Owner’s crypto wallet(s) can be transferred safely and securely so that it meets the requirement of being technologically accessible.

Activating the Plan In the Event of Death

As mentioned above, the Inheriti platform includes several failsafe mechanisms to protect against bad actors unlawfully triggering the recovery of the secret inheritable data. These mechanisms include ‘Dead Man Switches’ that will notify the original OE that a plan recovery process has been initiated and requesting them to respond within a set time period (defined by the OE themselves at the time of plan creation) using a combination of methods (including login or email response). The OE is essentially given multiple opportunities to confirm “I’m not dead yet”.

In the event that the OE does not respond within the allotted period, the “Dead Man Switch” is triggered and the platform releases the all-important encrypted “validator share” (i.e. Merge Authority share) which is just one of the many separate shares / pieces needed to recover the inheritable data – and the only share that is stored on the Blockchain.

The genius of Inheriti is therefore twofold:

Without this Validator Share being made available by the platform, according to the company, the decentralized inheritance plan cannot be unlocked and the inheritable data cannot be recovered.

Additionally, not only must all required ‘Dead Man Switches’ be triggered for this to happen, but the required number of Beneficiaries must also come together with each of their shares that were stored on the various, separate cold storage devices (‘SafeKeys’) mentioned earlier.

Think back to the famous (physical) intellectual property safeguard originally behind the Coca-Cola recipe: a certain number of company executives each had a particular ingredient to the recipe and, when brought together in a room, all the executives had the entire formula together. Without one, it was impossible to determine what the actual secret behind the most valuable brand in the world was.

And it’s for that reason, that Coca-Cola is still a mystery to the world, given numerous attempts at reverse-engineering.

Same logic is applied here with Inheriti, where once the beneficiaries come together, they merge their pieces of inheritance information, yielding a full decryption of the inheritable data.

Platform Security and Ongoing Audits

So, given the obvious and critical need to safeguard the security of the client’s inheritable data, how does Safe Haven ensure the security of its platform?

One of the things that initially captured my interest in Inheriti was the due diligence and steps Safe Haven are taking in ensuring its platform is safe for users, especially when it comes to their data privacy.

Firstly, as a web3 platform, Inheriti is built upon a three-layer distribution process – the Blockchain (validator share and/or backup shares), cold-storage via Safe Haven’s FIDO2 / U2F ‘SafeKey’ HSM devices (that utilize the company’s own Secret Sharing Distribution Protocol or ‘SSDP’), and the cloud (Inheriti Vault).

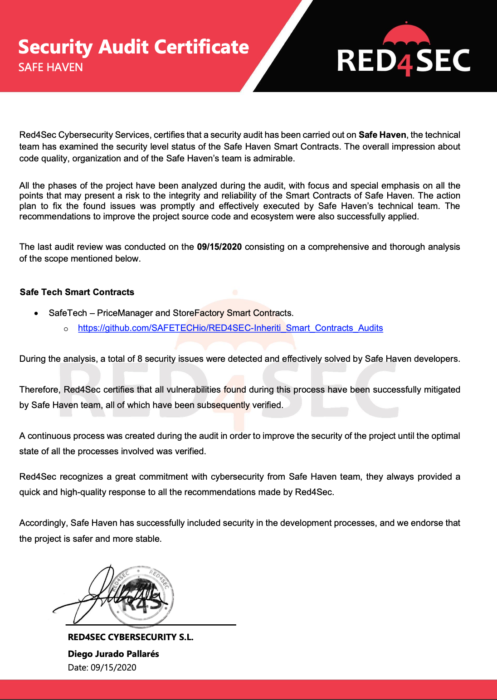

Secondly, in September 2020, the platform underwent a smart contract security audit, conducted by Red4Sec Cybersecurity Services. The purpose of the audit, according to Thomas Ambrosia, the company’s Head of Operations & Growth, was to focus on and place special emphasis on all the points that may present a risk to the integrity and reliability of all the smart contracts on Safe Haven’s platform. The audit explored SafeTech’s PriceManager and StoreFactory Smart Contracts. During the analysis, a total of 8 security issues were detected and effectively solved by Safe Haven developers. It was concluded that Safe Haven, as of September 15, 2020, and its smart contracts are “safer and more stable.”

Upon request, Ambrosia provided Benzinga with the security certificate confirming the results from the September 2020 security audit:

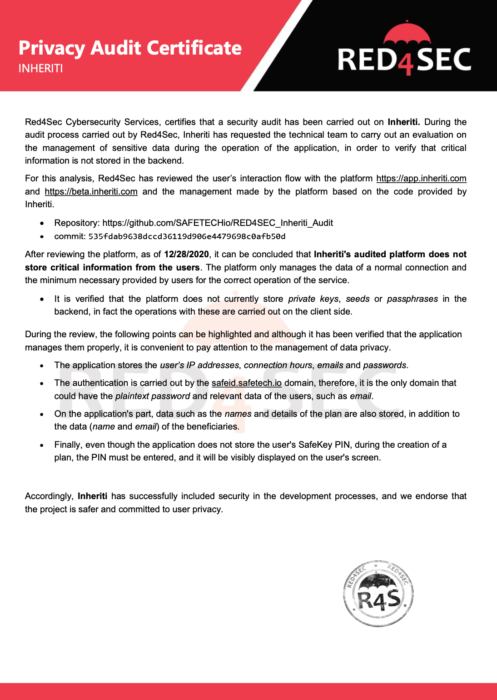

Then, in December of that same year, Safe Haven again underwent an additional security audit with Red4Sec Cybersecurity Services, but this time for its data privacy measures, Ambrosia explained. “The audit confirmed that Inheriti’s platform does not store any critical data, nor will the information and/or content users choose to store within their Inheriti plan be subject to risk,” he continued.

Upon request, the company also provided the Privacy Audit Certificate from December 2020’s audit report:

Jurgen Schouppe – Safe Haven’s Founding Director, CTO and acting CEO – also informed Benzinga that the company is shortly planning to launch a 24-month bug bounty campaign (to ensure continued validation of the Inheriti platform) in association with Intigriti, Europe’s premier ethical hacking and bug bounty organisation.

Overall, as of the date of this article’s publication, Schouppe confirmed that “there have been zero breaches of any client data and no discrepancies or disputes between clients and Safe Haven regarding any of the services they provide.”

Patent Pending and Intellectual Property Protection

Finally, the diligence the company took in seeking to protect its database with the U.S. Patent and Trademark Office (USPTO), among other international intellectual property agencies, has been extensive.

Back in November 2019, the company announced via Twitter that it had filed patents in the U.S., Europe, and China to protect its Inheriti platform and Secret Share Distribution Protocols. Hong Kong, according to the company is next on the list.

What Can Our Legal Landscape Look Forward To?

As our legal system continues to hear cases involving digital currency and NFTs, there is no doubt that our jurisprudence will begin to catch up to these newer technologies, allowing for attorneys to continue utilizing legal research databases to educate and inform their clients about developments in estate planning and digital property.

According to David Kerr, the organization’s Strategic Advisor, Safe Haven is “currently putting in place several foundational elements that will not only make Inheriti much easier for people to understand and use but will also position us extremely well to work much more closely with the legal profession, who we see as having a key role to play alongside our solution”.

“In the end, we’re all about removing barriers to adoption and ultimately, we see Inheriti as a solution that every crypto holder should be using,” Kerr added.

With what appears to be the only truly decentralized digital inheritance solution in the crypto space, it certainly looks like the company will have a promising future.

This article was originally posted by Benzinga

Back to news

Nederlands

Nederlands Deutsch

Deutsch Français

Français